START-UP, GROWTH, MATURITY & INNOVATION

Question: How do we develop a predictable and accurate forecast of the business environment?

Let's talk about the business lifecycle. Business lifecycle, in its simplest form, is about time and money. Time is years, months, or even decades. Money can be measured in different ways like profit, revenue, cash flow, time, opportunity, etc. As with business, products follow the same trajectory, in its most simplistic form.

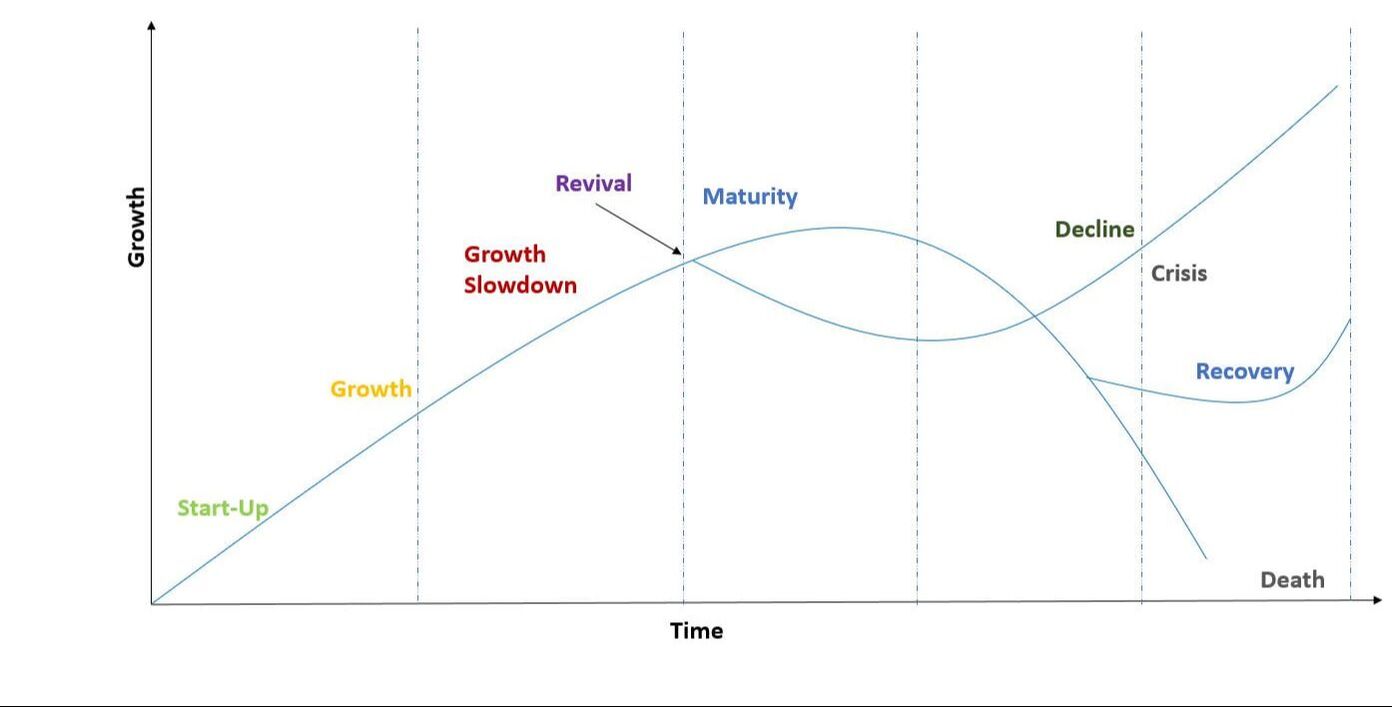

The company begins with its launch. It experiences growth. Sometimes rapid growth, like a firecracker on a short fuse. As it approaches the expansion phase, competition may become more aggressive and growth may realize a slow-down. This may also exert a much-needed shake-up or restructuring for a company revival. At the maturity stage, this is the reached pinnacle point. As its peak, the cycle turns downward. The decline begins. The signs are apparent and recognized as either a decrease in sales or cash flow. It is at that time, the company would inject a recovery mechanism or move towards closure. This is the classic business life cycle.

The company begins with its launch. It experiences growth. Sometimes rapid growth, like a firecracker on a short fuse. As it approaches the expansion phase, competition may become more aggressive and growth may realize a slow-down. This may also exert a much-needed shake-up or restructuring for a company revival. At the maturity stage, this is the reached pinnacle point. As its peak, the cycle turns downward. The decline begins. The signs are apparent and recognized as either a decrease in sales or cash flow. It is at that time, the company would inject a recovery mechanism or move towards closure. This is the classic business life cycle.

The Business Lifecycle

At the various stages of this lifecycle, the financial aspects look very different. The first and most obvious is sales or revenue. At launch, it is zero. Typically, it grows very rapidly during the growth phase. There is a peak to the sales growth as competition enters and following that peak, is the decline. The industry becomes mature and eventually declines.

When profit comes into the company, it may be a negative profit. The overhead to create the business generated debt to be paid back from the profit from sales. The break even point would be adjusted and once met, the company gains positive profit. The profit cycle lags the sales cycle. There's a time delay between the sales growth and the profit growth. Any funding goals would need to incorporate these theories into its financial modelling.

The third part of the cycle is cash flow. The actual cash of the business. Cash will lag profit. Consider the upfront costs to start the business. Many would be capitalized and not reflected in profit. It might not impact cash flow. In the early phases of the launch, cash dips, and perhaps more negatively than profit, then rises higher than profit in later phases when capital spending to drive the business is largely depreciated. Therefore, cash generation is higher than profit on the income statement.

The cycle can be repeated over and over again. There are so many examples. As the company lifecycle matures and goes into a decline, businesses do experience a lifecycle extension by reinventing themselves, reinvesting in technology, growth through acquisition or by extension. Depending on the paradigm shift, it would begin the process and cycle again. Important to note, the business management team may be very close to the events to recognize the timing. It might call it too soon or too late. For this, clients of ours have been very resilient by connecting us to the challenges early.

When profit comes into the company, it may be a negative profit. The overhead to create the business generated debt to be paid back from the profit from sales. The break even point would be adjusted and once met, the company gains positive profit. The profit cycle lags the sales cycle. There's a time delay between the sales growth and the profit growth. Any funding goals would need to incorporate these theories into its financial modelling.

The third part of the cycle is cash flow. The actual cash of the business. Cash will lag profit. Consider the upfront costs to start the business. Many would be capitalized and not reflected in profit. It might not impact cash flow. In the early phases of the launch, cash dips, and perhaps more negatively than profit, then rises higher than profit in later phases when capital spending to drive the business is largely depreciated. Therefore, cash generation is higher than profit on the income statement.

The cycle can be repeated over and over again. There are so many examples. As the company lifecycle matures and goes into a decline, businesses do experience a lifecycle extension by reinventing themselves, reinvesting in technology, growth through acquisition or by extension. Depending on the paradigm shift, it would begin the process and cycle again. Important to note, the business management team may be very close to the events to recognize the timing. It might call it too soon or too late. For this, clients of ours have been very resilient by connecting us to the challenges early.

|

|

“It's easier to hold your principles

100% of the time than it is to hold them

98% of the time.”

Clayton Christensen

Thought Leader

100% of the time than it is to hold them

98% of the time.”

Clayton Christensen

Thought Leader

|

|

Solutions

|

Counseling entrepreneurs on the 'how to's' and the essential business guidance to unravel the various logistics, funding and revenue issues faced by nascent entrepreneurs yielded a launch of 1,600 new companies and skills development training for over 10,000 entrepreneurs educated through a succinct series of programs, teaching the nuances and elements for each stage of the business cycle, from launch through maturity.

Directed the marketing and built out new venues and segmentation attracting over 10,000 attendees and over 1,000 exhibitors, with accredited conference speakers breathing new life into these long running global pharmaceutical events.

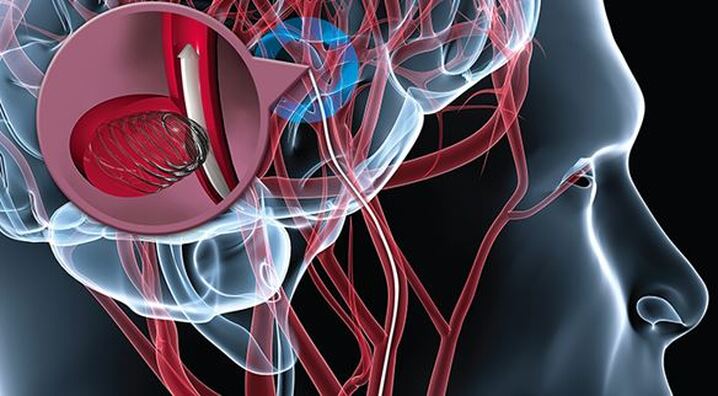

For this NYC ventures program, (first of its kind), supported start-ups at incremental stages with products in Digital, Tech, Data, BioSciences, BioTech, and LifeSciences. Advising scientists and engineers, physicians and post-doc students from in and around New York City's pedigree schools with the 'how to's' to navigate the world of life science and health tech business start up. Addressing the business skill needs and essential posturing for a selected venture capitalists community, commercialization opportunities through big pharma, or other innovation institutions by supporting hundreds of entrepreneurs in the NYC eLab programs, from the program inception through present day.

|

|

To distinguish brands inside IDNs and get the message in front of the Rx decision makers while augmenting the ‘No Sales Reps’ rule, targeted messages are delivered specifically inside the employee IP address.

|

case studies

Examples of how we help our clients navigate complex business issues and achieve high performance.